Before attending an INCPAS event you agree that you will not attend if experiencing COVID-19 symptoms, feeling sick or if you have been exposed to COVID-19 while being unvaccinated.

Frequently Asked Questions

What COVID-19 safety measures is INCPAS taking for in-person events?

What should I wear to class?

Is lunch provided?

Can I use my cell phone during a class?

What if someone needs to contact me while I'm in class?

Where is my event being held?

Where should I stay when traveling to Indianapolis?

How do I know if a CPE course meets the Indiana state requirements?

How do I know if a CPE course qualifies for Yellow Book?

How much self-study can I claim?

When does my class begin?

Can I deduct the cost of my meals?

What are my education requirements?

I recently obtained my license, what are my education requirements?

Understanding CPE Terminology

What qualifies for live CPE credit?

What is an in-person event?

What is a virtual live or simulcast event?

What is a webinar?

Still have questions? Call Member Services at 317-726-5000.

Policies and Procedures

Do you have to be a member to attend an INCPAS event?

If I am an AICPA member, can I get a discount?

How much do courses cost?

What forms of payment do you accept?

Is the course I want available?

Will I receive a confirmation once I've registered?

Does INCPAS ever cancel an event?

What if I need to cancel a course?

Are there fees to cancel or switch my registration?

What if the weather is bad the day of my scheduled event?

How to do I complete an evaluation of a course or conference I attended?

How do I obtain my CPE certificate?

CLE and CPE Disclaimers

CLE Disclaimer

CPE Disclaimer

Media Disclaimer

FREQUENTLY ASKED QUESTIONS

What should I wear to class?

Most attendees wear casual or business-casual attire.

Return to the top

Is lunch provided?

Course fees do not include lunch unless indicated. We offer a break area with snacks and drinks and there are several restaurants near INCPAS Learning Center. All in-person conferences include lunch.

Return to the top

Can I use my cell phone during a class?

Cell phones must be silenced or turned off during INCPAS events to ensure an optimum learning environment.

Return to the top

What if someone needs to contact me while I'm in class?

Messages will be posted outside the classroom or given to the instructor. We CANNOT interrupt class to relay a message unless it is an emergency.

Return to the top

Where is my event being held?

To find out where your event will be held, check the event confirmation email you received after registering or go to My Upcoming CPE.

Return to the top

Where should I stay when traveling to Indianapolis?

In Indianapolis, we have contracted discounted room rates with several properties. See the full list of venues we use and hotels in Indianapolis with discounted rates.

Return to the top

How do I know if a CPE course meets the Indiana state requirements?

Courses that qualify in the CPA minimum hour requirement must be formally organized, primarily instructional and contribute directly to professional competence in the practice of public accountancy.

Return to the top

INCPAS approved self-study courses are also eligible for credit in Indiana.

Contact the Indiana State Board of Accountancy at (317) 234-3022 for more information about non-INCPAS courses.

Return to the top

How do I know if a CPE course qualifies for Yellow Book?

CPE courses that qualify for the 24-hour Yellow Book requirement will be noted in the course description in our CPE catalog. Determination as to the qualification of certain courses for the Yellow Book 24-hour requirement should be made on an auditor specific basis depending on that auditor’s Yellow Book clients. Note that the determination of course qualification is a matter of an auditor’s professional judgement in consultation with appropriate individuals in the audit firm. The 24 hours are a subset of the 80 hour requirement.

Return to the top

How much self-study CPE can I claim?

You may claim up to 50% of your total CPE credits hours through self-study. Call the Indiana Professional Licensing Agency at (317) 234-3022 to learn more about their rules governing CPE.

Return to the top

When does my class begin?

All events begin and end on local time where the event is taking place.

Return to the top

Can I deduct the cost of my meals?

Under IRS Code Section 162 (effective 1/1/94), 50 percent of the costs of business meals held in conjunction with association meetings are generally deductible.

Return to the top

UNDERSTANDING CPE TERMINOLOGY

What qualifies for live CPE credit?

All in-person, simulcast, virtual live events and webinars qualify for live CPE credit.

Return to the top

What is an in-person event?

An in-person event is scheduled by INCPAS at a physical location, i.e. INCPAS Conference & Learning Center or an off-site facility. In-person events may or may not be simulcasted.

Return to the top

What is a virtual live or simulcast event?

A virtual live or simulcast event is scheduled by INCPAS using their instructors and will be completely virtual or simulcast (broadcast virtually in real-time) of a live in-person event. Both speaker and attendee interact with each other virtually using a chat feature and/or through a camera and microphone on a virtual platform.

Return to the top

What is a webinar?

A webinar is a virtual event scheduled with an outside CPE provider vetted by INCPAS. Both speaker and attendee attend virtually and interact with each other using a chat feature and/or through a camera and microphone on a virtual platform.

Return to the top

Still have questions? Call Member Services at 317-726-5000.

POLICIES AND PROCEDURES

Do you have to be a member to attend?

Registration for INCPAS events is open to the public. Members

of INCPAS or other state CPA societies may register under the member price. To become a member, complete a membership application or contact member services

for additional information.

Return to the top

If I am an AICPA member, can I get a discount?

A $30 discount for 8-hour courses, with AICPA listed as the vendor, is available to CPAs who are AICPA members. The $30 discount is available as a drop down when registering for courses online; when registering by phone, be sure to mention you are an AICPA member. The AICPA member discount is not available for four-hour AICPA courses.

Return to the top

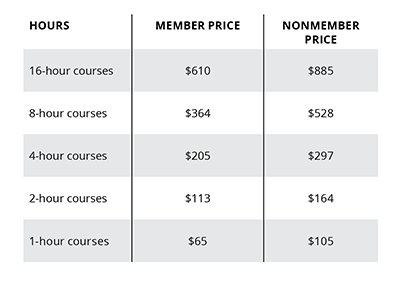

How much do courses cost?

2023 Course Pricing:

Return to the top

What forms of payment do you accept?

INCPAS accepts all major credit cards, checks and purchase orders for payment of CPE courses. If payment has not been received by the course date, you will still be allowed to attend, but your CPE certificate will be withheld until the balance has been paid in full. Webinars and on-demand courses must be paid in full before access to the course will be granted.

Return to the top

Is the course I want available?

- Call Member Services to check on the availability of a course.

- We cannot hold space in a course without full payment.

- On-site registration the day of the course is accepted only if space and materials are available.

- Payment of the nonmember fee is required for all on-site registrations.

Return to the top

Will I receive a confirmation once I've registered?

Registration confirmations and receipts are sent via email to address you've provided, once payment has been received. If you don't receive a confirmation 3 days prior to the course, contact Member Services at (317) 726-5000.

Return to the top

Do you ever cancel a course?

In rare occasions INCPAS will cancel a course:

- Courses may be canceled if there are not enough registrants by 10 days prior to the course.

- Canceled registrants may receive a full refund or choose another course without penalty.

- INCPAS is not responsible for any personal expenses incurred if a course is canceled.

Return to the top

What if I need to cancel a course?

If a registrant must cancel his/her course:

- Cancellations and switches are subject to an administrative service fee.

- Cancellations must be received in writing or by telephone.

- Another individual may be substituted for a registrant if the paid registration fee applies to both registrants (i.e. both registrants qualify for the member fee).

- Notify member services of any change to assure proper CPE credit.

Return to the top

Are there fees to cancel or switch my registration?

Yes. When we receive your registration, we begin making accommodations for you. Depending on when you need to cancel, some accommodations cannot be refunded. Fees for cancellations or switches are based on the following schedule:

- 15 or more business days prior to the event: $15

- 6-14 business days prior to the event: $25

- Up to 5 days prior to the event: 50% of the registration fee

- Less than 5 business days prior to the start of INCPAS-sponsored conferences: Nonrefundable registration fee

- On or after the event date: Nonrefundable registration fee

Return to the top

What if the weather is bad the day of my scheduled event?

Poor weather conditions at the site of the event

- Registrants will be contacted at their office during business hours and at home during non-business hours when an event is canceled due to inclement weather. Registrants need to make sure INCPAS has their current contact information.

- Registrants of events canceled due to inclement weather, may attend the rescheduled event or register for another event at the time of cancellation.

- Registrants who are unable to attend the rescheduled event and are unable to register for another event will receive a full refund.

Poor weather conditions preventing registrants' travel

- Registrants who are unable to attend an event due to inclement weather must notify the Society the day of the scheduled event.

- Cancellations will not be accepted before or after the event.

- If the Society has not canceled the event no refunds will be issued, but registrants will receive a credit voucher valid for one year from the date of issue for another event of equal value.

Return to the top

How to do I complete an evaluation of a course or conference I attended?

All course and conference evaluations are sent electronically. A link to the online evaluation will be emailed to you within two days of the course or conference.

Return to the top

How do I obtain my CPE certificate?

CPE certificates for conferences and courses are sent electronically. You should receive your CPE certificate within two weeks of the course completion date. CPE certificates can also be found under the My Account Section of the INCPAS website. CPE Credits can be viewed in My Account under the “My CPE Tracker” section of the INCPAS Website. CPE certificates and credits are not available on the website until the course has been reconciled and the full balance has been paid. Contact member services if you do not receive your CPE certificate. Make sure your email address is on file with INCPAS. If you have not received your CPE certificate, be sure to check your SPAM filter, and approve info@incpas.org as a sender. For conference certificates prior to 2020, contact member services to obtain a copy.

Return to the top

DISCLAIMERS

CLE Disclaimer

The Indiana CPA Society continuing education courses have presumptive approval by the Indiana Commission for Continuing Legal Education. Attendance at each approved course will be documented by INCPAS and forwarded to ICCLE for their records. It is the sole discretion of the ICCLE to determine what courses will be approved for CLE credit and how much credit can be earned for each approved course. Contact Julia Orzeske, executive director of the Indiana Commission for Continuing Legal Education, at (317) 232-1945 with any questions. To receive CLE credit, it is your responsibility to request it by signing in on the appropriate form during the course.

Note: ICCLE will assess a $25 fee for requests received 30-days or more after course and/or conference date.

Return to the top

CPE Disclaimer

The information and suggestions presented at the courses, seminars and institutes sponsored by the Indiana CPA Society are subject to constant change and, therefore, should serve only as a foundation for further investigation and study. Any forms presented at such courses, seminars or institutes are samples only and are not necessarily authoritative. All information, procedures and forms contained or used in such courses, seminars or institutes should be carefully reviewed and should serve only as a guide for use in specific situations.

The INCPAS and contributing authors and lectures hereby disclaim any and all responsibility, which may be asserted or claimed arising from or claimed to have arisen from reliance upon the information or utilization of the information or forms used in such courses, seminars or institutes. The opinions expressed by teachers or course leaders are not necessarily those of INCPAS.

Continuing education courses purchased from INCPAS may be deductible for federal income tax purposes as ordinary and necessary business expenses. Continuing education course purchases are not deductible as charitable contributions. Please consult your tax advisor for individual assistance in specific situations. Under IRS Code Section 62 (effective 1/1/94), 50 percent of the cost of business meals held in conjunction with association meetings are generally deductible. Inquire with INCPAS as to what portion, if any, of your registration fee represents direct meal cost.

Return to the top

Media Disclaimer

It is the policy of the Indiana CPA Society, Inc. ("Society") that any Society member or other person who attends a Society event, function or meeting consents to the Society's use of that member or attendee's name, voice, likeness, or image in Society advertising, fundraising, promotional, or educational materials, in any medium whatsoever, without payment of additional consideration to the member or attendee. By participating in or attending Society events, each member or attendee understands and agrees that (i) the Society may record or document its events with photographs, audio and/or video recordings, and other media; (ii) the Society will own any such photographs, audio and/or video recordings or other media; and (iii) the Society may utilize such materials, including without limitation, posting any such photographs, audio or video recordings, or other media on the Society's website, for any purpose the Society deems appropriate. Any member or attendee objecting to the possible use of his or her name, voice, likeness, or image in this manner shall communicate in writing his or her objections to or limitations on such use to the Society.

Return to the top