Have You Recently Obtained Your License?

872 IAC 1-3-16 Prorated continuing education requirements for holders of certificates granted during a reporting period

Authority: IC 25-2.1-2-15 Affected: IC 25-2.1-4-5

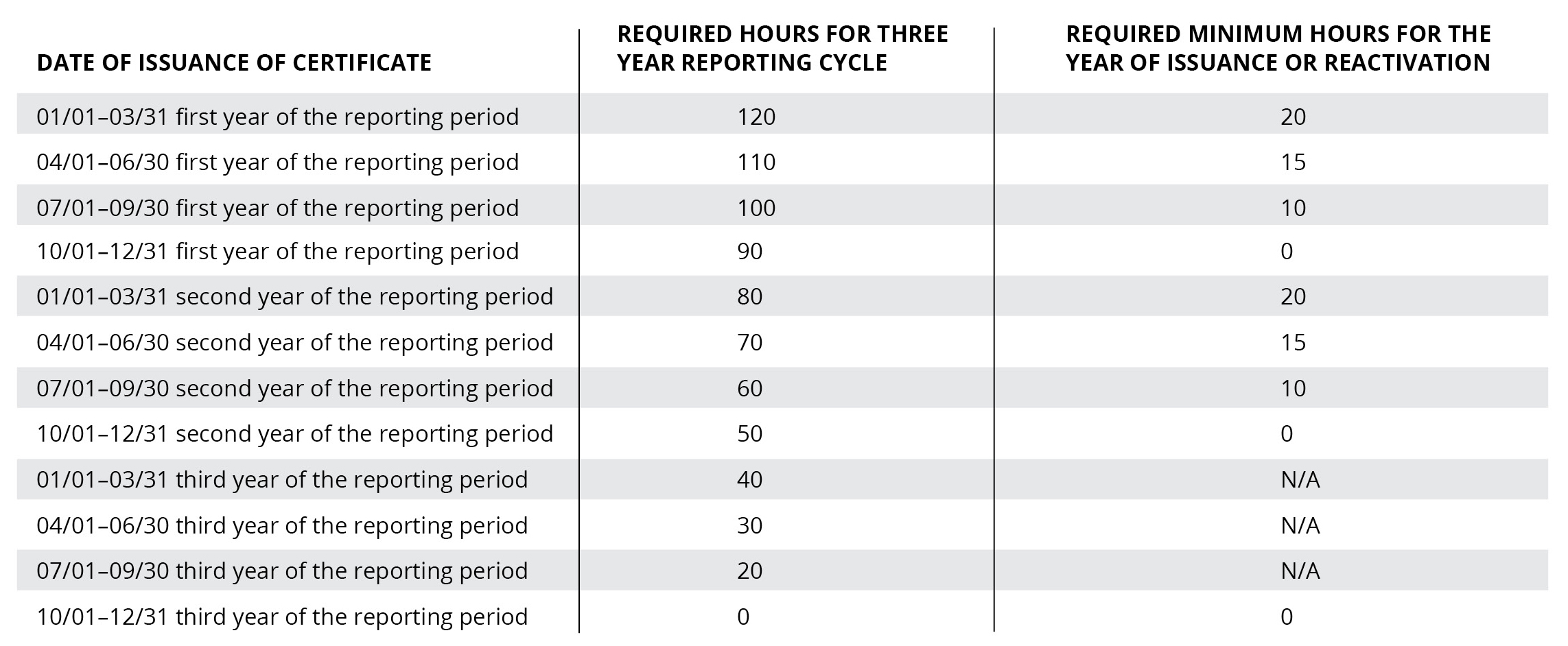

Sec. 16. The following table establishes the number of CPE hours that a licensee must obtain for the three (3) year reporting period in progress at the time of the issuance or reactivation of a certificate under section 8, 14, or 14.5 of this rule, and it also establishes the minimum hours required in the calendar year of the issuance or reactivation:

Contact IPLA to confirm special requirements for A&A and Ethics.

*For purposes of this section, “N/A” means that there is no specifically stated requirement for the year of issuance or reactivation because the licensee would have to obtain the prorated CPE hours for the three (3) year reporting period.