INCPAS has led the charge in reimagining CPA licensure pathways, publishing updated position statements and exposure draft comment letters in the January 2025 issue of Connect magazine. Since then, the landscape has continued to shift—both locally and nationally—and Indiana remains at the forefront of driving meaningful change. Here’s what you need to know.

1. INCPAS Secures a New CPA Licensure Pathway for Indiana Licensees

In January 2025, Rep. Heath VanNatter (R–38) introduced House Bill 1143: Licensure of Accountants, at the request of INCPAS.

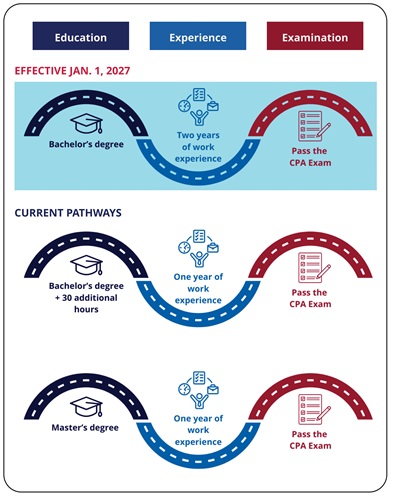

The General Assembly passed the bill in April and the governor signed it into law shortly after. The new law creates a third pathway to CPA licensure in Indiana: a bachelor’s degree (with an accounting concentration), two years of professional experience and successful completion of the CPA Exam. This new pathway will go into effect on January 1, 2027.

INCPAS led the effort from the start, anticipating the profession’s evolving needs and working closely with lawmakers to craft a solution. Our team proactively updated INCPAS’ position statements in 2024 to support expanded licensure options and create a more inclusive and sustainable pipeline.

Surrounding states are moving in a similar direction—Ohio has already passed a comparable law, and Illinois is actively considering legislation. Stay up-to-date on every state's legislation status here. See when new pathways go into effect for each state here.

View all seven of our position updates at incpas.org/Position.

Why 2027?

The bill (HEA1143) is not effective until January 1, 2027 to allow time for careful implementation and alignment with national efforts. Here’s the breakdown:

Interstate Mobility & National Consistency: Because CPA mobility provisions (which allow CPAs to practice across state lines) depend on states having substantially equivalent licensure requirements, it’s important that Indiana allow for states to make similar changes so as to not disrupt mobility. Many, but not all, jurisdictions are making moves this year; still more say they intend to make the change next year. A 2027 effective date gives ample time for alignment. Protecting national consistency to avoid disrupting interstate practice rights is crucial.

Administrative Preparation: Indiana’s Board of Accountancy, NASBA (National Association of State Boards of Accountancy), and CPA Exam providers (like Prometric) need time to update systems, rules, and guidance to accommodate the new pathway. This prevents administrative errors and ensures a positive experience for future CPA candidates.

Candidate Pipeline Management: Students currently in accounting programs need a pr

edictable transition. Immediate implementation could leave students caught between old and new standards. A future effective date protects them and allows colleges and universities to incorporate changes.

Strategic Leadership: INCPAS and the bill authors positioned Indiana as a leader in reform, but intentionally chose a responsible timeline that avoids rushing changes and undermining broader profession-wide goals.

2. INCPAS Completed Crucial Rulemaking Process to Bring Added Relief

In addition to pathways, INCPAS spent 2024 and 2025 carefully advancing the rulemaking process following the successful passing of HEA1327 Accountancy in 2023. Key licensure-related provisions—effective April 16, 2025—include:

Work Experience Requirement. Changes the CPA licensure experience from two years to one (Note: This experience references the current rule, which still requires 150-credit hours of education).

CPA Exam Window. Permanently changes the Exam credit window from 18 months to 36 months.

36-Month Start Date. Changes the start date of the 36-month window to the date NASBA releases a passing score.

Indiana candidates remain eligible to sit for the CPA Exam at 120-credit hours thanks to the INCPAS advocacy team’s efforts in 2022.

Thank you to our many member advocates who helped get ahead of the 8-ball with their early work on updating our position statements, getting HEA 1143 passed in the 2025 Indiana General Assembly and keeping our “Mega Rule” on track with state agencies to ensure we were ready to adapt to new opportunities presented in the CPA

licensure process.

What’s Next?

As more than half of U.S. states move to introduce new CPA licensure pathways in 2025, the profession continues to seek updates to the Uniform Accountancy Act. INCPAS and our peers submitted formal comments to NASBA and the AICPA by the May 3 deadline, reaffirming Indiana’s support for national recognition of multiple licensure pathways. You can read our comments at incpas.org/UAAComments.

We remain committed to working with NASBA, the AICPA and state boards to ensure the UAA evolves to reflect the profession’s needs.

For the latest updates and implementation details, visit incpas.org/Vision.