In our

previous feature in this series, we shared ways technology tools can help free up your firm and team’s workload for other things. But what ARE those “other things?” What value is there in saving time if it means less hours billed?

That’s where this third and final installment of the series comes in: the value is that you can begin focusing on services for your clients that shift you from administrative to indispensable.

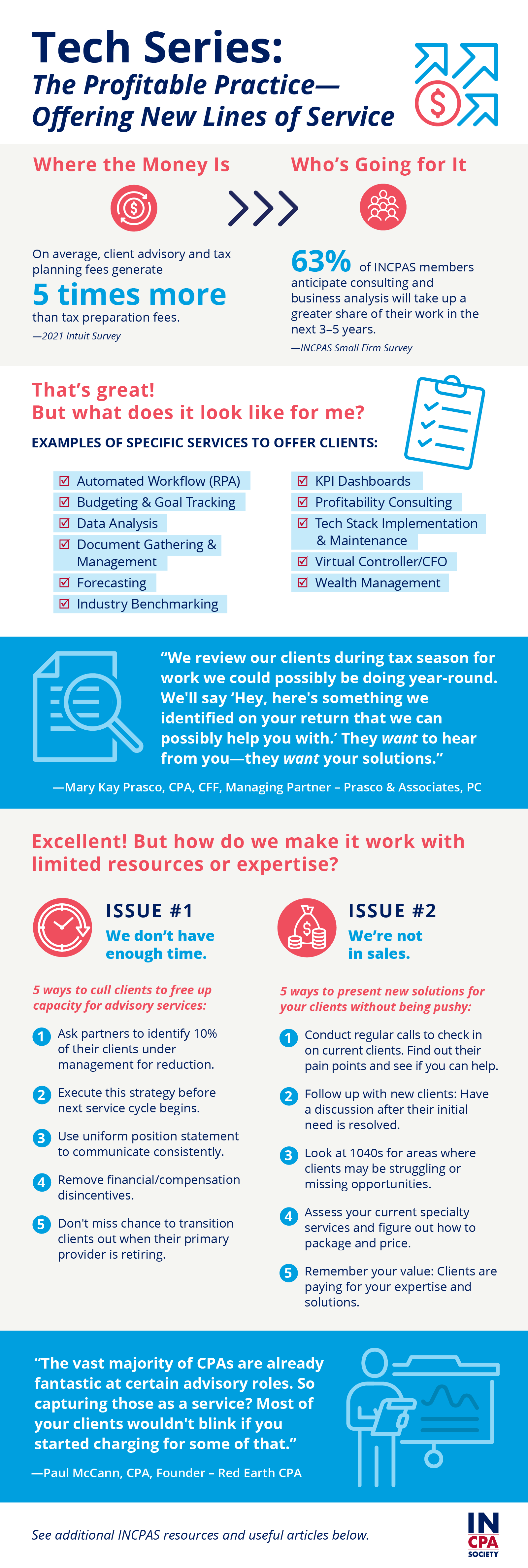

New lines of service—also known as “Client Advisory Services” (CAS)—are on the rise, and their financial potential for CPAs is very real. So real, in fact, that in 2021 services outside of traditional tax preparation generated

five times more revenue…and they weren’t all crammed into one tax season. These services are more profitable, sustainable, relational and, best of all,

in demand.

On the ground level, what do advisory opportunities look like for INCPAS members in particular? In our

recent survey, 98% of small firms reported they offer tax preparation services and that 90% of all their clients are based Indiana. Further, 85% report no plans to reduce staff size in the next 3–5 years, indicating they intend to maintain or grow their current client base, either through continued tax work or other means.

But how? The business marketplace is changing for consumers. As online shopping for

everything expands, the playing field is no longer set within local, state or even national borders. Whether it’s another firm with better lead generation tools, targeted product ads that show up first in a prospective clients’ keyword search results, virtual/outsourced contractors, or maybe even a new software that eventually eliminates the need for intermediary tax prep, firms will need to demonstrate a more robust service selection.

In Part 3 of our Tech Series, we’ll share examples of client advisory services and tips on how to begin capitalizing on them in your practice.

“Revenue growth from our advisory services has been tremendous. Some firms think they can’t do them, but they can—these are specific skills you already have. You just need to know how to sell, package and price them.”

—John Seale, CPA, CITP, managing partner – RBSK Partners, LLP

CPA.com Practice Area Resources: Client Advisory Services

There are many resources available at CPA.com/Client-Advisory-Services including:

Technology Peer Networks

Facilitated by INCPAS staff, these peer groups are your opportunity to connect with other small firm CPAs who are navigating the ever-changing landscape of tech tools and service. Come prepared to share ideas, successes, failures and, most importantly, get peer advice so you’re not starting from scratch.

If you want to join a network, let us know and we will follow up with you.

Sources & Additional Reading

INCPAS Pulse Survey: “Indiana CPAs report concern for employee safety; losing clients and revenue”

INCPAS Small Firm Q&A: Tech’s Impact on Your Bottom Line

Intuit: 2021 Tax Planning & Advisory Insights Survey

Journal of Accountancy: Right-Size Your Firm Client Base

CPA Practice Advisor: Client Experience for Today’s Client Advisory Services

What Are Accounting Advisory Services: Consulting & Advisory Services Explained

7 Questions Firms Need to Ask Themselves to Grow Their Advisory Practice

Did you miss the first two infographics in this tech series?

Tech Series: Practical Tools for Small Firms to Generate Big ROI

Tech Series: Solutions to Create More Capacity for Your Team