Indiana Department of Revenue

Jan 18, 2024

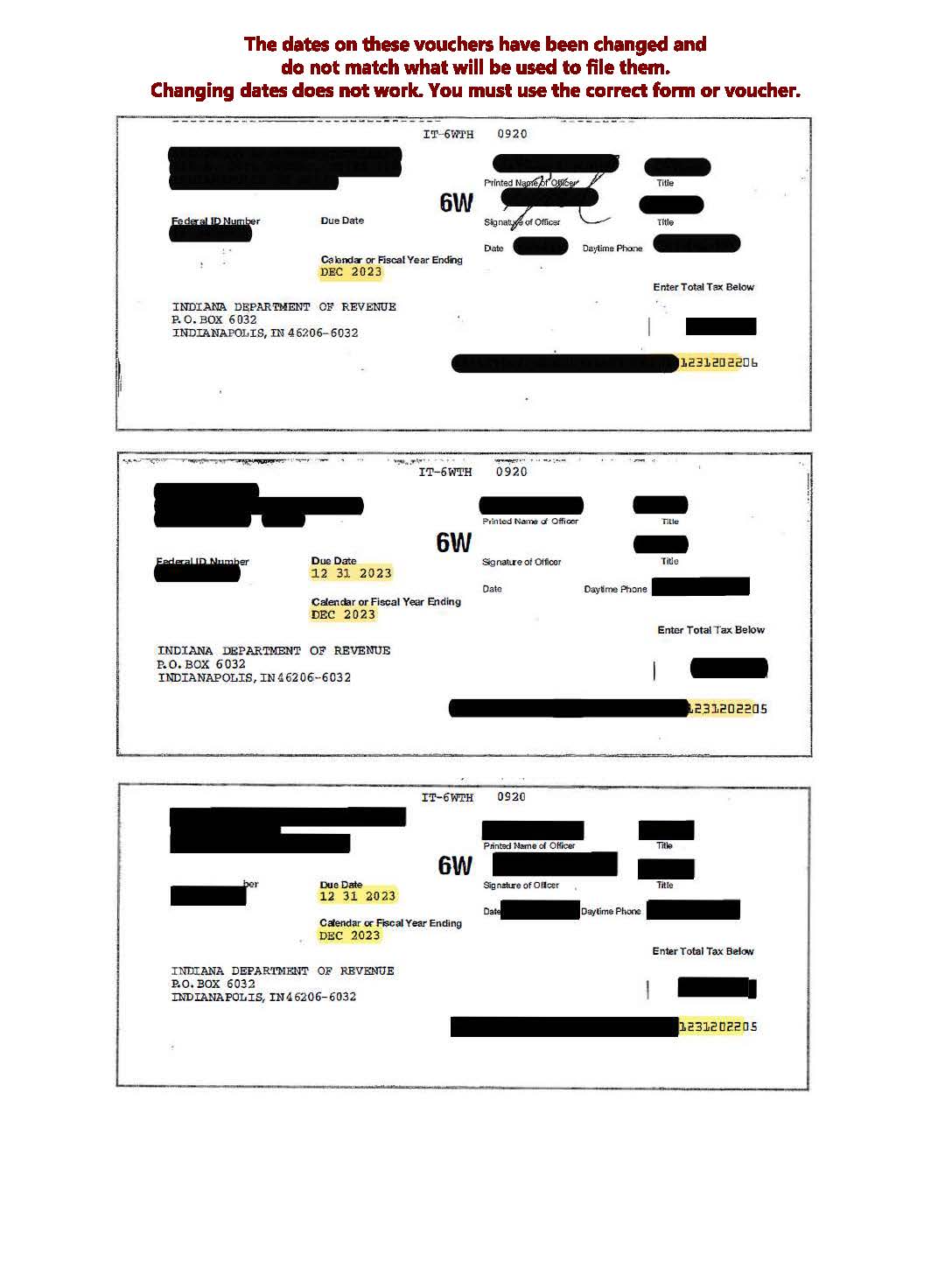

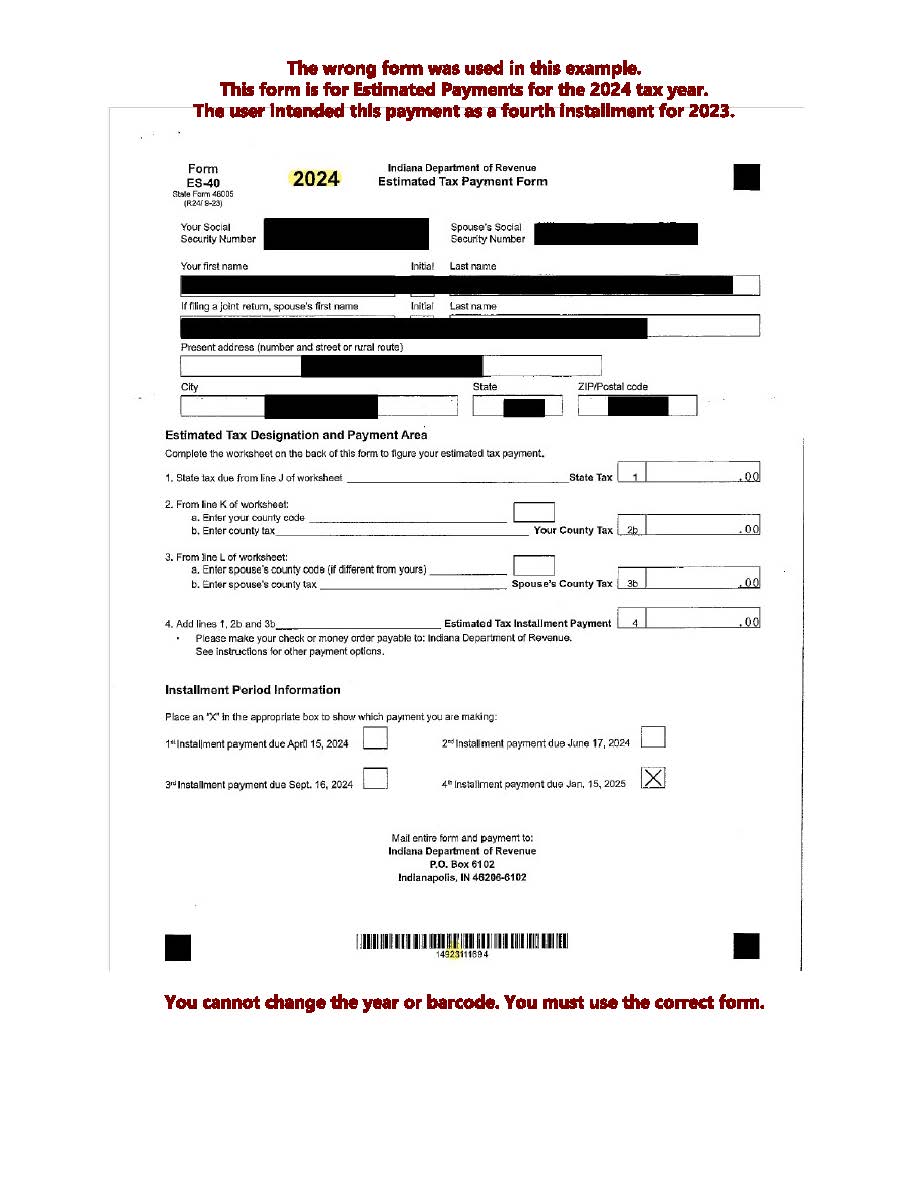

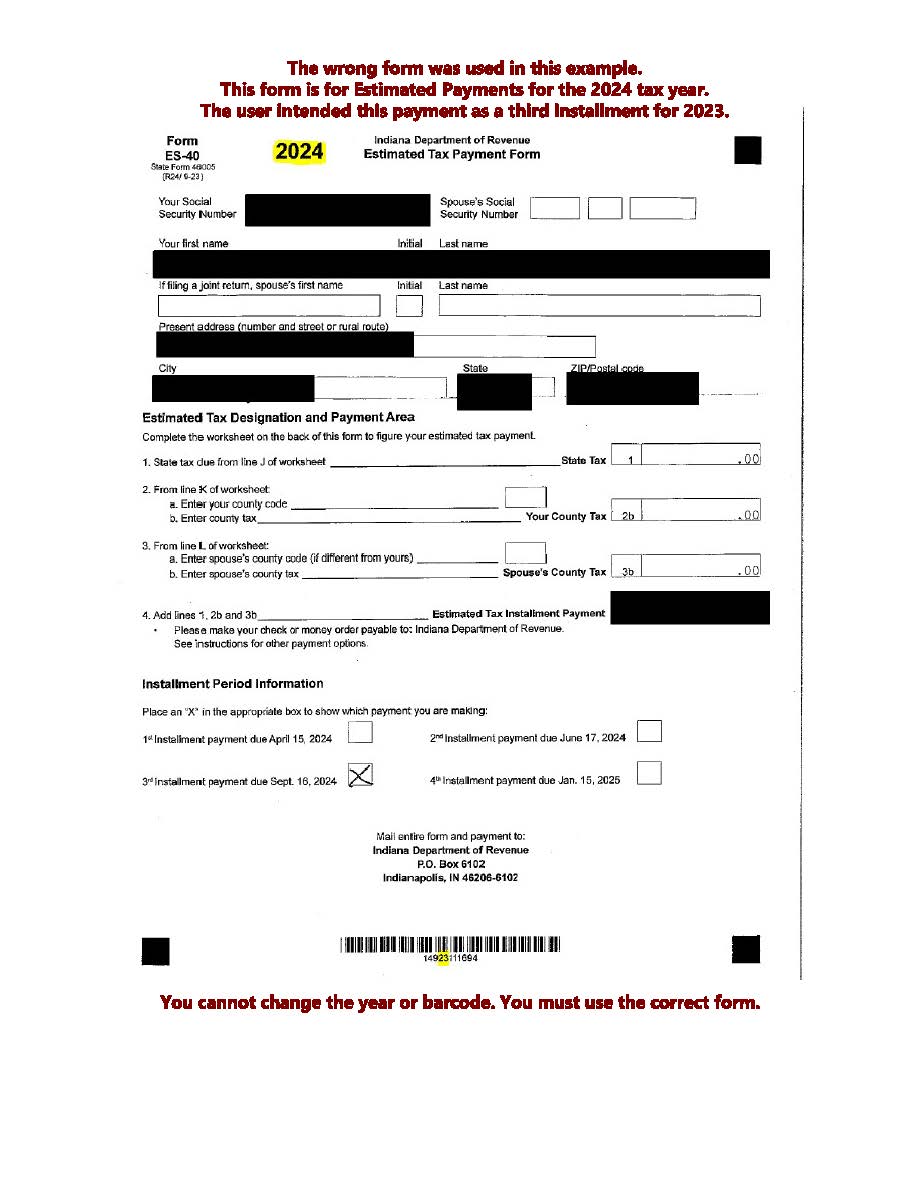

DOR wants to remind CPAs and taxpayers to not manually change any part of a tax form issued by the Indiana Department of Revenue — including the year — as this will not apply your intended information and/or payment to the correct year and/or potentially the correct taxpayer. This will result in the payment being applied to the wrong quarter or year, which then creates penalties and interest on the outstanding liability for the taxpayer that will not be waived. Or, it may result in a refund that is not due to the taxpayer, again resulting in confusion and costly, time-consuming fixes.

You must download and use the correct year’s form from our website or through your software provider. Do not reuse old forms with manually edited information, as this will not fulfill your desired effect.

Get current year tax forms.

Download the most recent IN-PTET Form and read the instructions.

Digitally manipulated and handwritten changes do not truly change the intention or identity of a form; the identities of forms are in the barcode for the sake of DOR’s high-speed filing system (i.e., the year at the top of the form does not influence how the form is read and filed; the barcode does, and this cannot be changed by any user but the agency each year a new form is created.). Changing forms may result in unexpected/mistakenly issued refunds or bills that could incur interest and/or fees.

DOR will process your filings as submitted.

This applies to every form, but please review these specific examples that illustrate the most commonly misused forms already collected by DOR this year.

For any additional questions, you can contact the DOR Practitioner Hotline at (317) 232-2240.

Related Content

Related Content